For the first couple weeks of December, I had a note on my desk. It said, “Make a crypto trade.” Then after a week of looking at that, I wrote “Seriously!” next to it.

For the first couple weeks of December, I had a note on my desk. It said, “Make a crypto trade.” Then after a week of looking at that, I wrote “Seriously!” next to it.

I made my first official trade on an exchange on December 22, 2017. Once I got going I made a bunch more trades and finally got my portfolio of altcoins settled on January 2, 2018. The image to the left is my current portfolio.

There are a few things I learned along the way and even though I still have a long way to go, I thought I’d put them out there, just in case others are wondering, too.

- I found my best help and advice on Facebook and Twitter. I joined a cryptocurrency group on Facebook and started following people on Twitter. The comments, questions, and advice given in that group was amazing. I would save Facebook posts and when I was at my computer I would pull up the saved posts, research the coins mentioned and then do my own research on the coin to see if I liked it and if I wanted to keep it for a while. The group I joined is called SCM and you have to be a student of Suppoman‘s and have taken at least one of his Udemy courses to join this group. I highly recommend his courses.

- I learned there are a lot of fees with altcoin trading and moving your coins around. It is best to research the fees involved and think about your long-term plan before you start transferring your coins. For example, when I first bought Bitcoin on Coinbase, I set up the transfer to move it straight away to Bittrex, a cryptocurrency exchange, but when I saw the fees involved in moving the Bitcoin I about had a heart attack. I wanted to move a measly $100 USD and the fee was over $12 to move it. Yikes!

- Another quick lesson – move small amounts of coin first to make sure you know what you’re doing. The public keys are long. The process can be daunting. So don’t transfer a lot of coin from one place to another and hope for the best. What if you mess it up and you’re out all that money. Small amounts first!

- Coinbase and GDAX are an awesome couple. GDAX is the exchange for Coinbase and you can move your coins from Coinbase to GDAX for free. Then fees to move coins from GDAX to another exchange are significantly less. So first I moved my Bitcoin to GDAX and then from there moved it to Bittrex and made my first trade by buying Myriad (XMY). I did some research, I liked what the coin was about, it had been around a while, and it was just over a penny a coin when I bought it. It was a small trade I could do with my small amount of Bitcoin to see how it all worked.

- Another important lesson I learned was that Two Factor Authentication, though seemingly scary, is actually quite easy and increases your security. I’ve set up 2FA on my phone and on every exchange and wallet I have. Here’s how it works. You download the app from your phone’s app store and then you opt in to 2FA on the sites you’re using. They give you a 2FA key and you keep that somewhere safe, then you scan the 2FA QR code with your phone and it starts to generate a 6-digit code. When you log into that site again, when you transfer coin, when you do anything really, you look up that 6-digit code for that site on your phone and you put it in. It basically matches your phone with your account on their site and no one else can log into your account without your phone. It’s not perfect because bad stuff could still happen, but it’s better. Your money is out there, you have to keep it safe.

- This brings me to the next lesson. Get a hardware wallet! Once you have purchased coin and you have it sitting on an exchange, if you’re going to keep it for a while, you want to move it from the exchange somewhere safe. You can set up a paper wallet, and that’s great, but you need a safe place for that paper. A place away from water, fire, your dog, etc. I opted to buy a hardware wallet. I got the Ledger Nano S for about $130 from Amazon.com. I am still in the process of setting this up, but it brings me back to the second thing on my list. Have a long-term plan to move your coins that minimizes your fees.

- For example, I was going to move all my coins (I have purchased nine altcoins, besides Bitcoin, Ethereum, and Litecoin) to a desktop wallet. I decided to start with a coin that was worth about .10 USD each and only move the minimum to see how it worked. I set it all up and saw that the fee to move 120 District0x (DNT) was 60 DNT! Whoa, what?!? So it would take half my DNT to move my DNT. And if I wanted to move the rest later, it would take another 60 DNT. Ok, so my DNT cost me roughly 17 cents each, so the total to transfer was about $9.60 USD, but still. If I did it again, it would cost another $9.60 and my total supply of DNT was about $200 USD worth, so I would be paying about 20% to move it. So I decided not to. I decided to wait and move it all at once into my hardware wallet. I know, I said move small amounts. Once you know what you’re doing and you double-check your public key, try and limit your fees by moving more at a time.

- The other thing I learned about fees is that Bitcoin fees are crazy high. I started buying Ethereum and Litecoin on Coinbase. I transfer that to GDAX (because remember it’s free to do that) and then I transfer those from GDAX to an exchange. The coins move a lot faster and for a lot fewer fees. You can always exchange your Litecoin or Ethereum for Bitcoin once it’s moved where you want it to buy other coins.

- Finally, I learned there are a lot of fun acronyms that altcoin traders use. When I was first in the Facebook group and on Twitter I felt like they were speaking another language. So I Googled a lot of the terms. Here are a few:

- FOMO: Fear of Missing Out

- FUD: Fear, Uncertainty, Doubt

- Mooning: When a coin price increases dramatically. It seemed to all start with this Reddit post.

- Altcoin: This refers to any coin that is not Bitcoin.

- HODL: This one is my favorite. It started originally as a misspelling of HOLD when Bitcoin was falling drastically in 2013 but is now a term used by anyone who is going to buy coins and “hold on to them for dear life.”

- DYOR: Do Your Own Research. There are about 2000 altcoins out there. Look them up, decide what you want to buy, know what the coin is about. There is nothing worse than posting about a coin online and having people shred you because you don’t know what you’re talking about.

- Lambo: I’ve heard this a lot in the last few days. It means kind of what you think it would. It’s a symbol for someone who has made enough in altcoin gains to buy a Lamborghini.

- ICO: Initial Coin Offering. This would be like a stock going public for the first time. Groups that create a coin to fill a need have a period of time called an ICO where they recruit investors, where they get followers and where they work out the details of their white paper. When you invest in an ICO, you get a certain number of coins for a very low amount. The company might also give you a certain number of coins for free for investing and then when that company launches and is listed on an exchange or two or five, the initial investment you made could grow by thousands and thousands. Or it could fade away to nothing. It’s a risk.

But then all of this is a risk, right?

It took me about two weeks to put together a nice portfolio that I am Hodling. I have watched the market dip and rise and I am not letting FUD rule me. I also watch coins I passed on go up with no FOMO. And one of my coins also already mooned, though no butt cheeks were involved. I already sound like I know what I’m talking about, right?

I have also found an ICO that I’m going to invest in if I can. Residents of the USA are limited in the number of ICO’s they can be a part of. Something about government regulations.

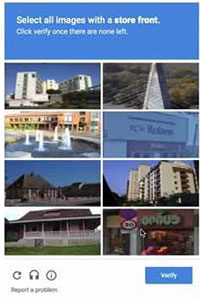

I recently learned about Gems, the protocol for decentralized mechanical turk. Essentially, there are already people paid very little in gift cards or check to do work that can only be done by a human. A good example is the Google verification check where you see nine images and you have to select the images that contain a sign or a bridge or a storefront. How does Google know which image contains a storefront? Because they paid someone pennies on the dollar to select those images. Before you see those images, perhaps 10 or 20 or even more people were paid to pick those images out. The people who do this work are called micro-task workers. Many of them are unbanked (cannot use or do not have access to a bank account) so they have to cash out their paycheck. And if they are paid in a gift card, they are limited on what they can use it for.

I recently learned about Gems, the protocol for decentralized mechanical turk. Essentially, there are already people paid very little in gift cards or check to do work that can only be done by a human. A good example is the Google verification check where you see nine images and you have to select the images that contain a sign or a bridge or a storefront. How does Google know which image contains a storefront? Because they paid someone pennies on the dollar to select those images. Before you see those images, perhaps 10 or 20 or even more people were paid to pick those images out. The people who do this work are called micro-task workers. Many of them are unbanked (cannot use or do not have access to a bank account) so they have to cash out their paycheck. And if they are paid in a gift card, they are limited on what they can use it for.

The Gems altcoin aims to change this by eliminating consensus by redundancy (having people do the same work over and over again), increasing pay for individual workers, and enabling computer literate workers with internet to work with or without a bank account. Gems will take back the reigns from central digital labor marketplaces (like Amazon, Uber and TaskRabbit) and provide a solution that benefits all the participants.

I like the sound of this. I joined their Telegram group and I’m posting this so that anyone reading can DYOR and lookup Gems.